Article: Risk of money-laundering fine for Danske unchanged despite court victory in US

A U.S. judge’s decision to dismiss a securities fraud class action against Danske Bank A/S related to a large-scale money-laundering scandal may be a relief for Denmark’s largest lender, but it does not reduce the risk of a fine from U.S. or European authorities, according to legal experts.

Nor is the decision likely to impact the large number of shareholder lawsuits filed against Danske in Denmark, with law firms representing investors there saying the cases are not comparable to those in the U.S.

Danske could pay a total of 12 billion kroner, approximately $1.9 billion, in fines and damages to authorities and shareholders, according to an estimate from Jyske Bank analyst Anders Vollesen.

Danske told S&P Global Market Intelligence that it was “pleased” with the decision by the U.S. federal district court to dismiss “all aspects of the civil shareholder claims brought against Danske in the U.S.” The bank would not comment on how the ruling could impact other lawsuits and investigations but said it “will continue to defend our position in civil shareholder claims […] both in the U.S. and Denmark.”

Failed to prove knowledge

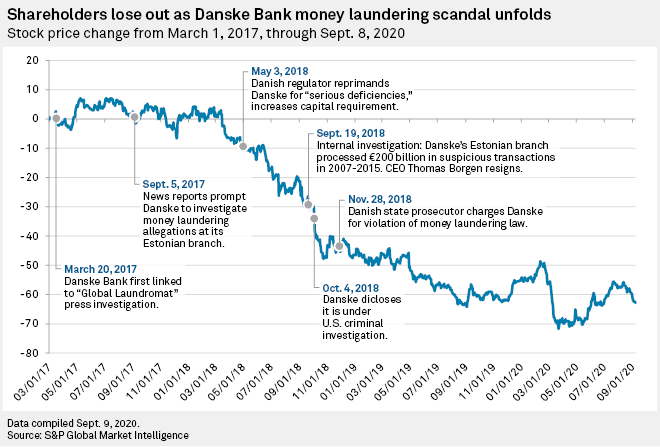

In the U.S. securities case, Plumbers & Steamfitters Local 773 Pension Fund v. Danske Bank A/S et al, plaintiffs had sought damages for investors who lost money in Danske’s American Depositary Receipts, a type of security representing shares in a foreign stock, from January 2014 to April 2019.

The class action followed revelations that €200 billion of nonresident money flowed through Danske’s Estonian branch from 2007 to 2015. An internal probe revealed in 2018 that a “significant” number of these transactions were suspicious, and that a whistleblower had notified Danske’s management about shortcomings as far back as 2013.